Achieving financial freedom is one of the top things everyone desires. But with everything desirable, it doesn’t come easy. To achieve our dreams or succeeding in ventures require making healthy financial habits a part of your life.

While most of us use up the little we save on bills and survival, financially savvy individuals choose to save up and respect the rules of borrowing and expenditure. We have compiled some rules of trade that will help you manage money better. In other terms, spending money and ensuring you never run out of funds. This is how self-made millionaires save their money.

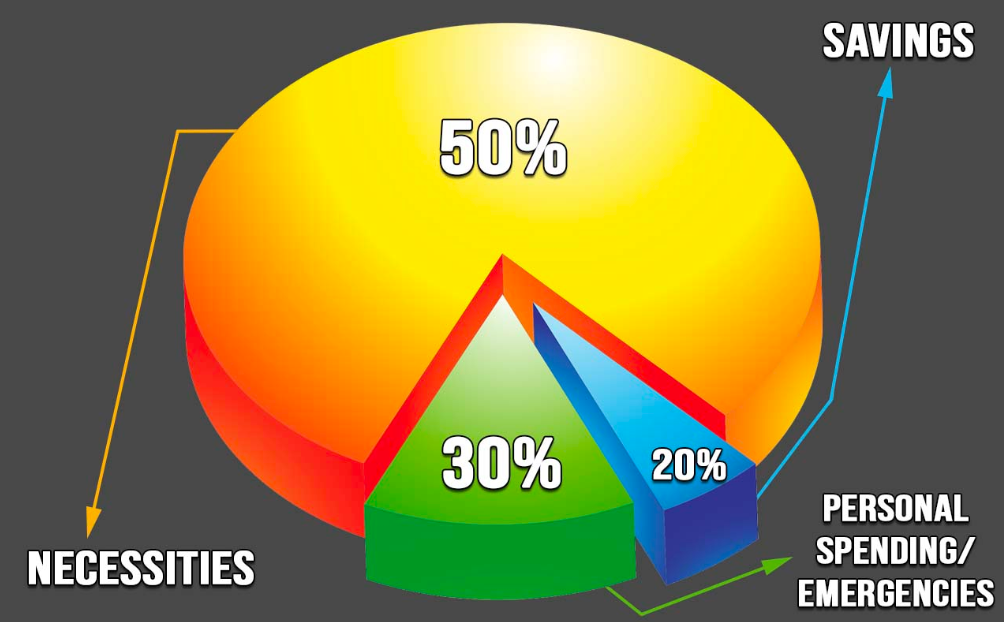

#1 Following the 50/30/20 budgeting rule.

Elizabeth Warren- US senator from Massachusetts and Harvard bankruptcy expert is credited for coining the ‘50/30/20’ rule for spending and saving. Working alongside her daughter Amelia Warren Tyagi, they determined that from the after tax income, one should limit their needs to 50% of the after tax income. This includes things like groceries, housing, health insurance and housing among others. The key is differentiating between needs and wants.

The next step is limited one’s wants to 30%. Therefore, before going on a shopping spree, its advisable to try and check whether its something that you really need or not. The last step ‘20’ in the rule is spending at least 20% of the income to repay debts and saving money for retirement. This is a crucial step that ensures steady savings completely untouched.

#2. The 24-hour rule

This rule is simpler than it sounds. It involves taking 24 hours to think over every non-essential purchase. This helps one avoid impulse shopping. Taking 24 hours gives us time to mule over the benefits and thoughts of the purchase. Having second thoughts can convert a need to want allowing one to walk away from the idea and save some cash.

#3 Carrying a reasonable amount of cash and limiting credit card use

Credit cards saved us the trouble of having fat wallets and carrying cash around. But our lives were simplified at a cost of huge debts. Millionaires prefer carrying cash around than plastic cards since forking out bills is a great reminder of the significance of the purchase.

Having credit cards increases one’s chances of spending. This is a well known secret to bankers who keep pushing their customers to open new credit accounts.

#4 They live a frugal lifestyle while avoiding unnecessary debts

The wealthy only make purchases that they can actually pay for in cash. This frugal lifestyle helps them keep off huge debts. For instance, going on a vacation using a credit card can be fun until the few weeks of fun turn into years of debt with hefty interests. Use your credit card to make purchases if you are sure your monthly statement is able to clear the accumulated bill.

#5 Creating a shopping list for annual sale and avoid purchasing items at full price

In the spirit of making sure money is well spent, in times of dire need, take a moment and create a list and wait for sales to get a good bargain. Compare prices and opt the seller with the lowest price. As long as quality is not compromised, you will have paid less than the usual price.To complete the final step, deposit the savings from your purchase into your fixed deposit account. Make it a pattern and in the long run, you shall see the benefits.

#6 They invest in things that make them happy instead of splurging

As a rule of thumb, strive to spend money on memories than tangible things. Once in a while Spending money on a toy that will make you happy is okay. However, millionaires choose to ‘work hard and play harder’. This way, they invest their money on things that keeps them happy while also improving their quality of life.

#7 Enforcing strict ‘no spending’ days or weekends

Set out a limit for yourself, except in emergency cases, all urges to spend is resisted. Opt for homemade food or cycling to work. During this period, the urge to shop is often heightened but resisting this urge could prove beneficial in future.

When you reduce the non-essential wants, you will come to realize there is a lot of things that you can ultimately live without while maintaining your level of lifestyle.

#8 Having a loose change savings

Instead of saving every coin and small bill that passes your way, start saving them. Since some of us live from paycheck to paycheck, we are enslaved in a cycle of debts and loans. Locking away 20-30% of your earning might be hard but putting aside loose change is something we can all do.

Although loose change doesn’t amount to much in the long run, but being committed to this simple habit might prove to be a life-saver in the future. As warren Buffet says’ we should invest in ourselves before anything else.’

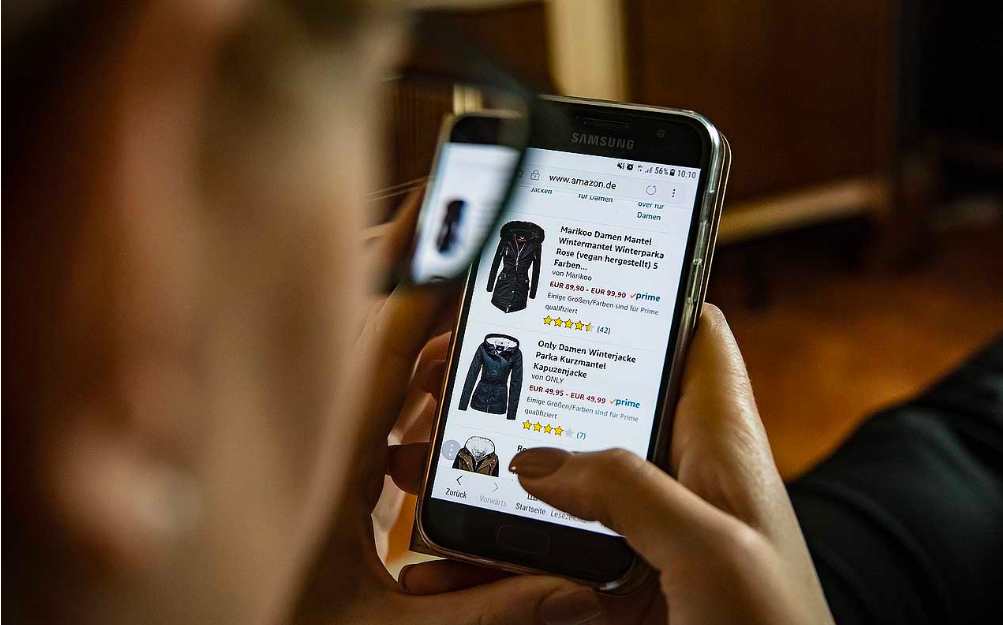

#9 Not having auto-saving credit or debit numbers

Online merchants love the idea of keeping your credit or debit number in hand ‘to make it easier for you in future’. It might look like genuine tactic aimed at ‘saving you time’ but most shoppers don’t know that this tempts you to spend more since it ‘simplifies the shopping experience’

#10 They’re patient

While there are individuals who became millionaires overnight, the reality might be saying otherwise. The average millionaire has one motto to live by; ‘patience is a virtue’. This is why most millionaires don’t make their breakthrough until they’re 40-50 years old.

#11 They fix things instead of discarding them

Fixing things saves us money and makes our environment cleaner. While most rich people make sound investment decisions, they also have the habit of fixing things that most of us think of replacing. A little effort goes a long way, plus with sufficient skills, it could make up for a great business idea.

#12 They spend more money on experiences Not materials

We work hard in order to get a chance to spend some money. Most times, we want to ensure that our hard-earned cash is well spent. A research conducted by a psychology professor at Cornell university found that spending money on experiences is far much better than spending on items. Rich people invest in experiences that will make reflect more on life.